Trusted by Leading Funds

Sample Client Success Stories

3x Faster Fundraising

"Within a week we had initial LP screening tailored to us that allows us to source the right LPs, run far more engaged meetings, and move 3x faster with successful fundraising."

— Ross Barrett, Managing Partner, Cancer Focus Fund

5x Faster Screening and Diligence

"AIx2 partnered with us in a critical time to achieve 80% time savings with sharper insights for deals initial screening and due diligence in less than 1 week."

— Victor Orlovski, Founding Partner, R136

10x Faster Sourcing and Scoring

"In under a week, AIx2 built the backbone for our sourcing and scoring — something other major AI providers had failed to deliver."

— Will Ballard, Chief Data Officer, Prime Unicorn Index

Unified Platform of Three End-to-End Workflows

End-to-end workflows for LP sourcing, screening, outreach, and due diligence — raise capital 3x faster.

Fundraising Workflow

End-to-end workflow for LP sourcing, screening, outreach, and due diligence — raise capital 3x faster.

Investment Workflow

End-to-end workflow for thematic deal sourcing, screening, outreach, and due diligence — never miss a top deal.

Deal Exit Workflow

End-to-end workflow for GP sourcing, screening, outreach, and vendor due diligence — achieve exits 4x faster.

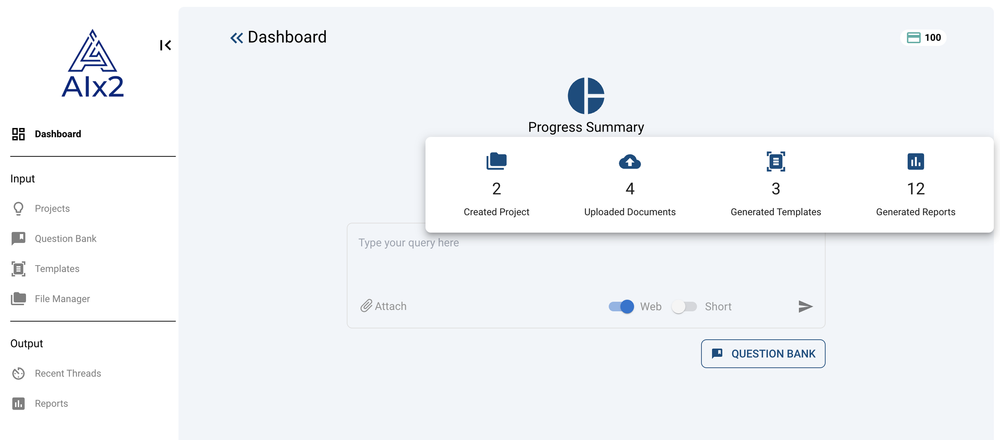

Five Core Modules Hyper-Tailored to Your Fund Thesis

Each of the three workflows is powered by our five specialized AI modules tailored to your fund unique thesis, working in sequence to deliver comprehensive results

Thematic Sourcing

- • Deal discovery

- • LP identification

- • Buyer sourcing

Thematic Screening

- • Deal scoring

- • LP fit analysis

- • Buyer assessment

Contact Finder

- • Decision makers

- • LP contacts

- • Buyer executives

- • Maximum relevancy contact

Outreach

- • Outreach strategy

- • Tailored message

- • Maximize relevancy

Due Diligence

- • Investment DD

- • LP query responses

- • Vendor DD

- • Risk assessment

Security and Compliance

Don't risk your proprietary data being trained on public AI models or exposed during audits. Choose a platform that's built compliant and secure.

Data Privacy Guaranteed

Your fund data is never trained on public LLMs. Proprietary information remains fully private and secure.

SEC Compliant

17a-4 archival to meet SEC compliance and regulations, ensuring your fund meets all regulatory requirements.

Access Control

Granular access controls prevent internal and external breaches, giving you full control over your data.

Enterprise-Grade Security

Enterprise-grade safeguards protect your data from hacks and breaches at all times.